2019: Insurtech in Review

Happy “National Science Fiction Day” to all of you that enjoy reading a great SciFi book or had a chance to see the latest Star Wars entrant. I hope you had a great holiday season with family and friends. As I reflect on 2019, I’ve been blessed to work and interact with amazing people like yourself. I am forever grateful for this. Here’s to the next year and decade together. May it be filled with only great things, health, success, and happiness for you and your family.

2019: Insurtechs take hold (but will they hold?)

In last year’s email, I started off with the fact the Everquote had gone public in 2018 and was down 80% since its IPO. What a difference a year makes. As of the end of 2019, Everquote was up 700% YTD. Too bad I didn’t invest Jan 1st 2019! They are just one example of where Insurtechs and start-ups have started to gain traction.

Personal Auto

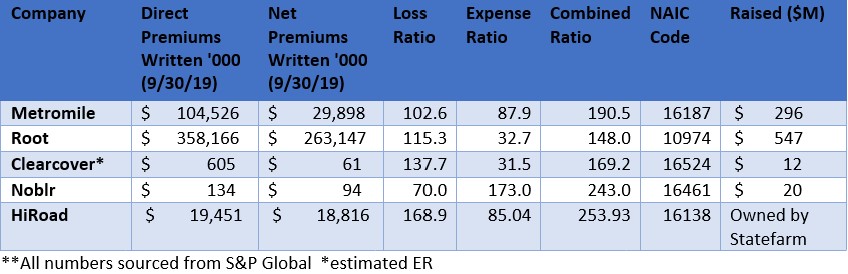

It’s much easier to track the growth of the Insurtechs within the personal auto sector. Four Insurtechs: Metromile, Root, Clearcover, and Noblr have collectively raised $875M and they have created traditional full-stack insurance carriers as compared to acting as an MGA. Thru the 3rd quarter in 2019, they had written over $450M in combined premium. Root itself, in 2018, was the 107th largest private auto writer in the country. Not bad for a few years in business! One entrant, HiRoad which was founded by Statefarm and only writes in Rhode Island has written just under $20M in their first year.

An interesting fact: in 2018, HiRoad wrote $12M in coverage while their parent Statefarm only wrote $18M in Rhode Island

While these carriers have seen significant premium growth, they all struggle when looking at their combined ratio (and especially their loss ratio). I found it ironic that HiRoad had the highest combined ratio, given its roots in Statefarm.

Renters and Home

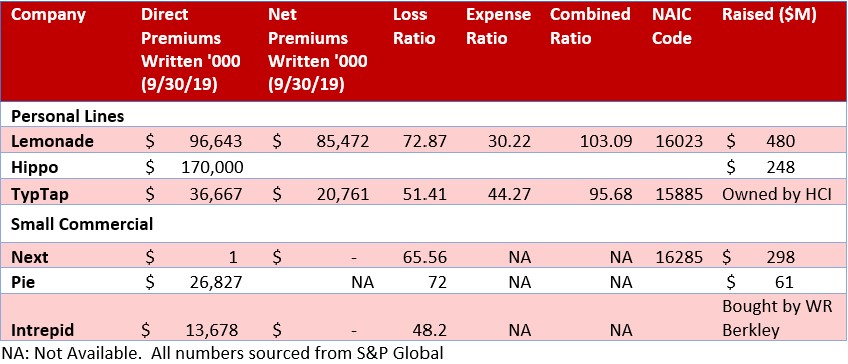

In the Renters/Home-owner space, Lemonade wrote $97M in premium in the first 9 months of 2019. Hippo Insurance (which is an MGA and doesn’t report directly) wrote close to $170M in premium. Lemonade has certainly tamed their loss ratio however; they are still just above a 100 combined ratio.

Another niche Insurtech is TypTap which sells flood insurance online. In the first 9 months of 2019, they wrote about $37M in premium with a combined ratio of 96%.

Small Commercial

In the small commercial space, Next Insurance continues to expand and has formally created a full-stack insurance carrier. While it has only reported $1k in premium through 3Q19, they have probably written over $40M YTD. Intrepid Insurance (which is part of WR Berkley) is a startup focused on selling directly to niche small business categories such as franchises and auto repair shops. They have written $13.7M through 3Q19. Pie Insurance, which sells workers compensation insurance online as written about $27 (through Sirius America Insurance). This doesn’t include the likes of Hiscox, biBerk, and Chubb’s small business marketplace to name a few of the legacy carriers upping their focus on small business.

A Natural (and low) Ceiling

We all read and followed the collapse of the WeWork dream. It was a dream. Billions of dollars poured in with little evidence of a workable business model. The Insurtech world suffered much of the same. Many companies were funded without a clear vision for profitability. Coverager just published a report on ~175 of these inactive startups.

Will this change. Not a chance. There is too much investable money out there. With T-bills at historic lows and some European countries with negative interest rates, Investors are chasing any potential return. What will change though is the exit strategy for the Insurtechs. They will have to have a profitable product or provide something of value to a Carrier (who would then acquire them).

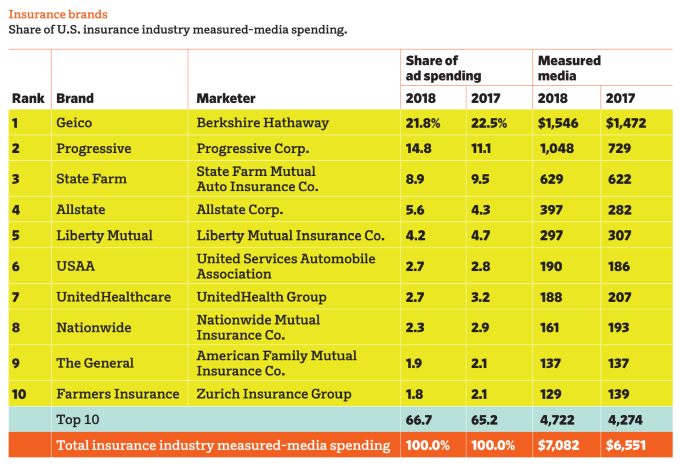

Another barrier to growth is brand recognition. Whether you are B2B or B2C, you need brand recognition to grow. For the Insurtech carriers (and MGAs) to truly grow they will have to start to spend advertising dollars that most likely exceed their raised capital. The top 10 Insurance advertisers spend just under $5B annually. Will Hippo, Lemonade, or Next spend 10s of millions on advertising? Unlikely, but it’s anyone’s guess. WeWork did some crazy illogical things.

Source AdAge 2019

2020: To Enable or Not?

Perhaps the area that I see of greatest potential is around Insurtechs providing a service to the legacy Carrier community. Rather than treat Insurtechs as just a new type of vendor, successful Carriers collaborate with or even acquire the Insurtechs. This allows the legacy carrier to quickly benefit from the entrepreneurial culture and technical creativity of Insurtechs, while the founders at the Insurtechs benefit from the industry’s market expertise, capital, and brand recognition. It’s a win-win!

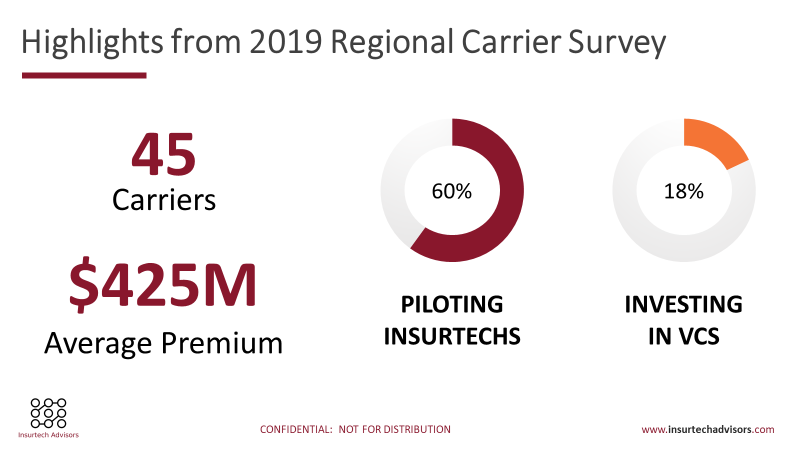

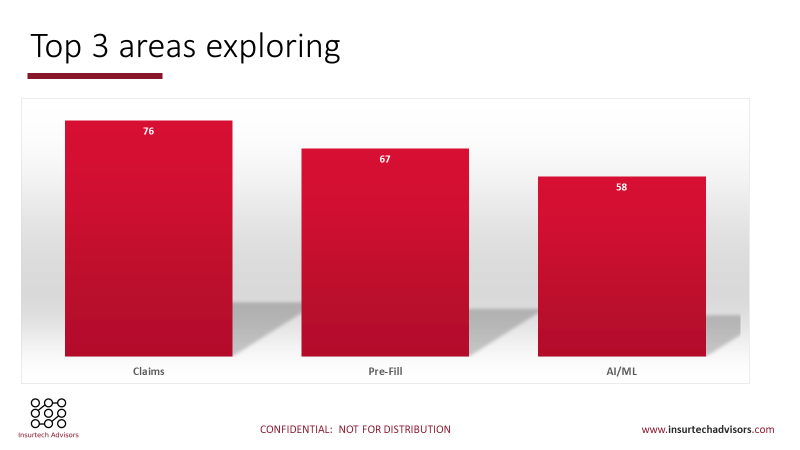

We surveyed Insurance Carrier CEOs this past summer as to what Insurtech areas they were exploring, and what POCs they ran and what was successful. The highlights are below. If you want to learn more, please reach out!

There are plenty of enabling Insurtechs to discuss, but I’ll leave that for another post.

Happy New Years and I very much look forward to staying in touch.

Insurtech Advisors is dedicated to helping regional insurance carriers plan for the future today. We help you identify and partner with Insurtechs. This enables you to thrive and continue to meet the needs of your members, employees, and independent agents.