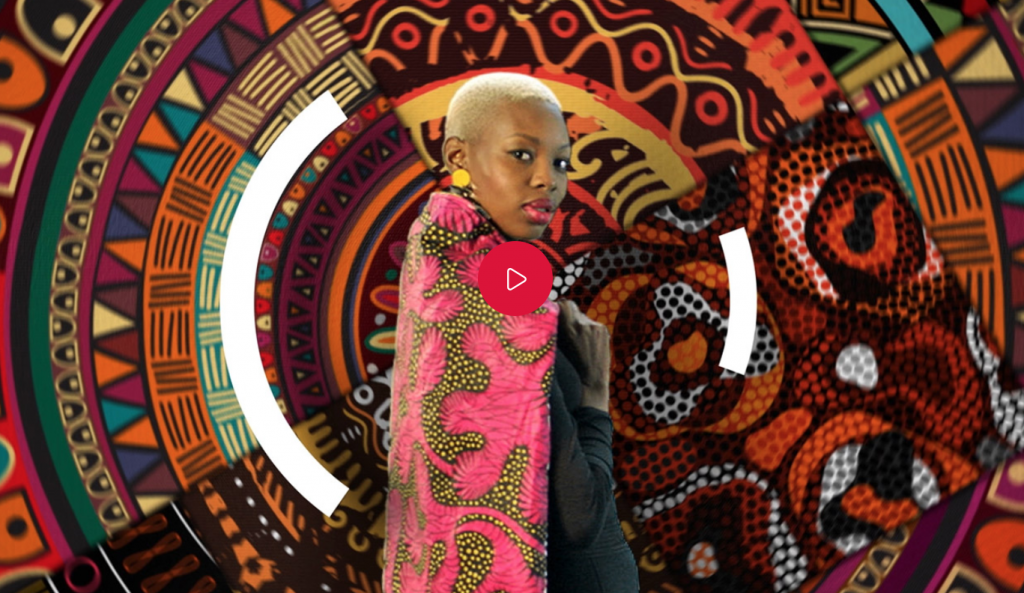

A Winner: Samkelisiwe Ngubane

After six months of financial boot camp, 27-year old Samkelisiwe Ngubane successfully overhauled her life and was named the overall winner of the Absa/City Press Money Makeover Challenge.

The challenge tested the resolve of five candidates and although they all passed the test with flying colors, Samke, as she is known, was selected as the overall winner of the competition.

With an exceptional amount of hard work, she experienced both a financial and personal transition during the course of the challenge. “When I first met Steven Williamson, my Absa financial planner, he told me that when my finances are in order, I will get the other aspects of my life in order, and that taking control of my finances, will bring balance to my life. At the time, his words didn’t make sense to me, but today this is my truth, today this is my reality,” Samke recalls.

Within six months she managed to settle all her short-term debt and established an emergency fund now equalling one salary cheque, and the balance is growing. Her goal of being debt-free by 30 was fast-tracked to being debt-free by 27.

Samke also experienced a significant personal shift during the six months, she explains “If you look at the first picture that was taken of me when I entered the competition and compare it with how I look today, the change is evident. For me, the makeover not only impacted my finances, but my life. I am no longer depressed and I am much happier. Even my partner recently noticed that there was something different about me, that I seem alive and happy. And that is how I feel every day, I now go to gym and I have changed my look completely.”

Samke, who works as a financial controller at a Sandton-based holdings and investment company, had to lay down boundaries for her family commitments, which include supporting her parents in KwaZulu-Natal as well as a young girl the family adopted. With her financial planner, she managed to set a fixed amount aside in her budget to support her family and has learnt to say ‘no’ to additional financial requests.

She also had to review the monthly amount she was giving to her church. As someone who believes in giving, she had to realise that the only sustainable way to give is to make sure your own finances are stable and that you cannot give to charity using your credit card. Due to her more robust budget she was able to manage a financial setback when her mother needed to be hospitalized without tapping into credit or her savings.

Samke’s ultimate goal is to buy a new car. She realized that she was not yet ready to buy a new car and is actively saving towards a deposit to reduce the monthly installments.

Samke proved herself to be a worthy Money Makeover Ambassador by using the platform to educate her peers. Every Sunday she bought copies of City Press and circulated them to friends. She gathered a WhatsApp group and engaged her friends and peers using this channel and inspired them to share their money stories. She has also been mentoring three colleagues who have shared her Money Makeover journey.

“We selected Samke for the competition as she represented the average 20-something year-old young professional who has made all the usual financial mistakes with their first salary. Her story was an opportunity to show that the mistakes in your 20’s don’t have to compound into your 30’s – if you are prepared to take action now.” says personal finance expert Maya Fisher-French who oversaw and documented the competition.

Other exceptional achievements by the five contestants included paying off and closing down an array of personal loans, snipping credit cards and store cards as well as significant improvements in their respective credit scores.

“None of them achieved this because of a higher salary or winning the lotto. This was all achieved by simply having a financial plan in place and sticking to it, even during the Festive Season when most of us overspend. They are proof that the power to change your financial circumstances lies within yourself and that you do not have to wait for some ‘miracle’ to achieve financial freedom,” says Fisher-French.

All candidates were tasked to make some tough decisions on every aspect of their finances during the course of the six month challenge.

“In our current economic climate, where consumers increasingly feel financially squeezed and have to do more with less, financial discipline is crucial. The temptation to take on additional debt to ease these pressures is always greater than cutting expenditure to save for the long term. As a caring lender, we take our broad societal responsibilities very seriously and over-indebtedness is a significant threat to the long-term financial security of families,” says Songezo Zibi, head of Communications at Absa Group.

“Thankfully, the work necessary to managing your finances – such as paying off your debt and then converting the free cash into savings – is achievable with the right dose of discipline. These were people who claimed that they did not have enough money to settle their debts and start saving, yet within six months all of them had a complete money makeover, and we are immensely proud of them,” he says.

The conclusion of the Money Makeover Challenge comes at a challenging period in the history of our country. “On the eve of the National Elections, we are faced with persistent issues such as load shedding weighing our economy down, placing business owners and consumers under tremendous financial pressure. There is no doubt that the banking sector needs to constantly sharpen its pencil to play a greater role in educating customers to change their relationship with credit,” concludes Zibi.