Azibo raises $19 million

Azibo, the financial services platform for the rental property market, has raised a $19 million Series A round led by SVB Capital, with participation from new investors RET Ventures, Liberty Mutual Strategic Ventures, Victory Park Capital, and Gaingels, as well as existing investors Canaan, Khosla Ventures, QED Investors, Camber Creek, Assurant Ventures, and Context Ventures.

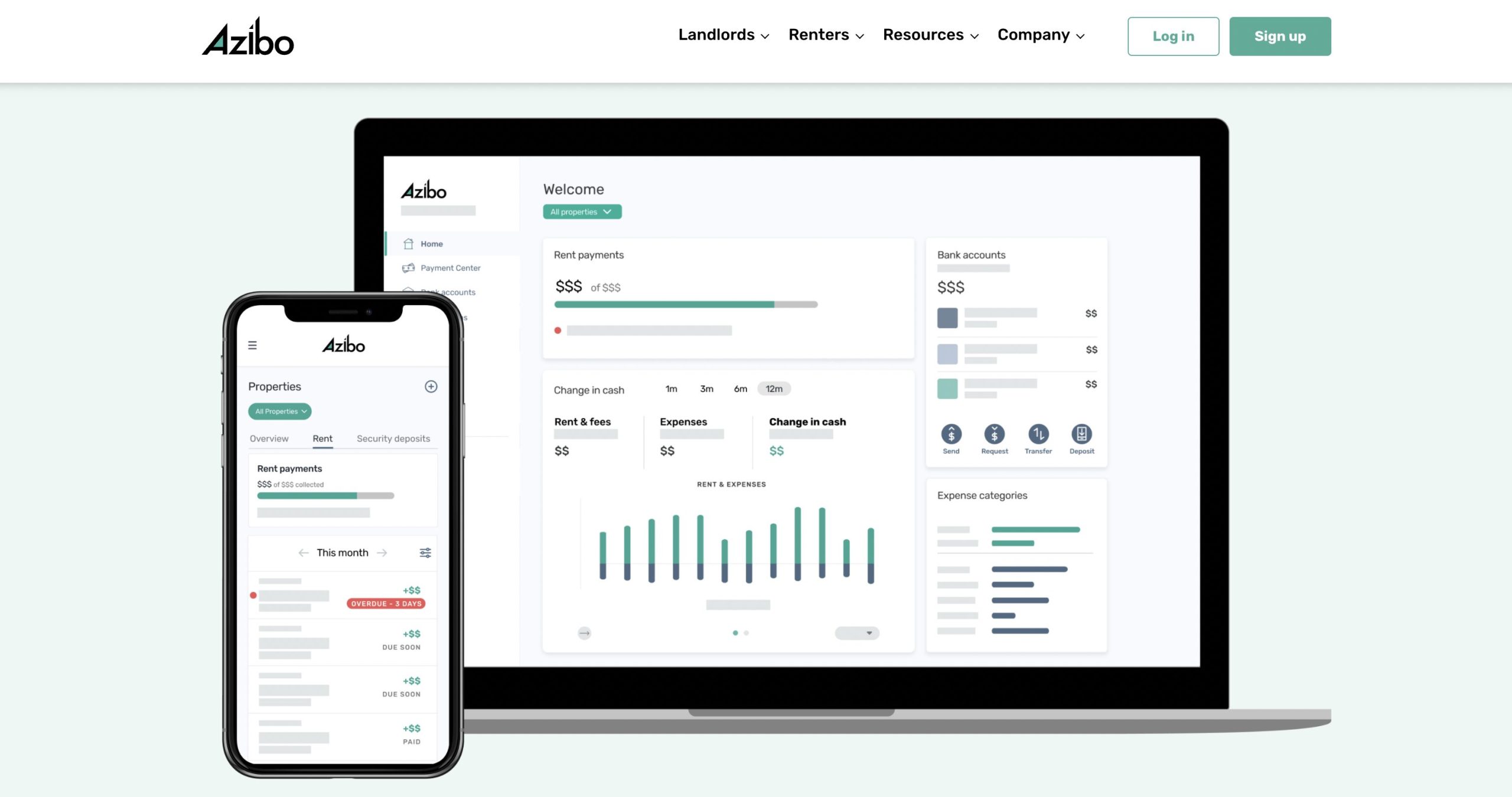

Founded in 2019, Azibo, formerly Zibo, offers a variety of free features to help landlords manage their rental properties. These include banking services, rent collection, tenant screening, and more. Azibo also has an insurance offering for both landlords and renters. The latter is powered by Sure.

To date, Azibo attracted over 10,000 customers.

“Since launching the company, we’ve focused on building an all-in-one platform that simplifies rental property finances and levels the playing field for independent landlords and everyone they interact with. With this funding, we will accelerate our priorities of delivering innovation on our core products, driving commercial success, creating awareness in the market, and building out our amazing team.” – Chris Hsu, CEO and Co-Founder of Azibo.

“Azibo has brought needed innovation to an underserved market, demonstrating momentum at the intersection of FinTech and real estate. We are impressed by the team’s deep understanding of the rental property sector, and we’re excited to help them get to the next level.” – Beau Laskey, managing partner at SVB Capital.

“Real estate technology products have proliferated in recent years, but independent landlords have largely been overlooked. Azibo’s powerful platform is poised to transform this massive market. The company’s robust product suite is already delivering tangible value to its users, and we’re proud to join the company’s journey as it improves the financial side of operations for a growing number of residential landlords.” – Aaron Ru, VP at RET Ventures.