Hub launches VIU by Hub

HUB International announced the launch of VIU by HUB , a new digital platform for “transactional personal insurance needs,” such as home and auto.

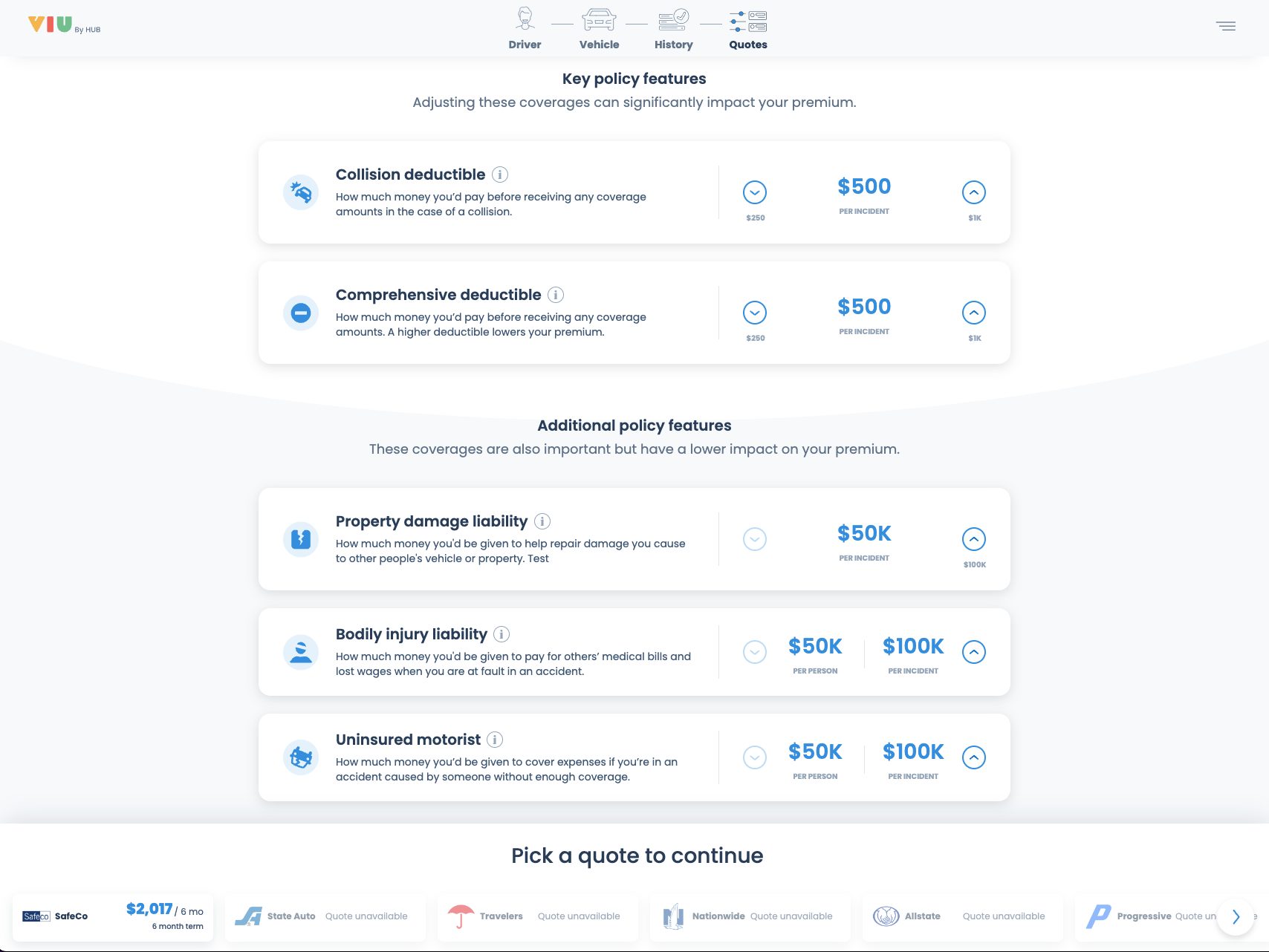

The platform will feature auto and home quotes from “over 25 top insurance companies” including Farmers, Travelers, Allstate, Progressive, Nationwide, Liberty Mutual, and State Auto. Currently, the platform supports auto and home quotes only and those looking for other products (life, renters, pet, etc.) will need to connect with a Hub agent.

Hub says that the platform will allow customers to engage with the company “how and when they want in an omni-channel experience,” but when it comes to buying a policy there’s only one option and that is to speak with a Hub agent. It also appears that availability is limited as we weren’t able to receive an auto or home quote in the state of South Carolina.

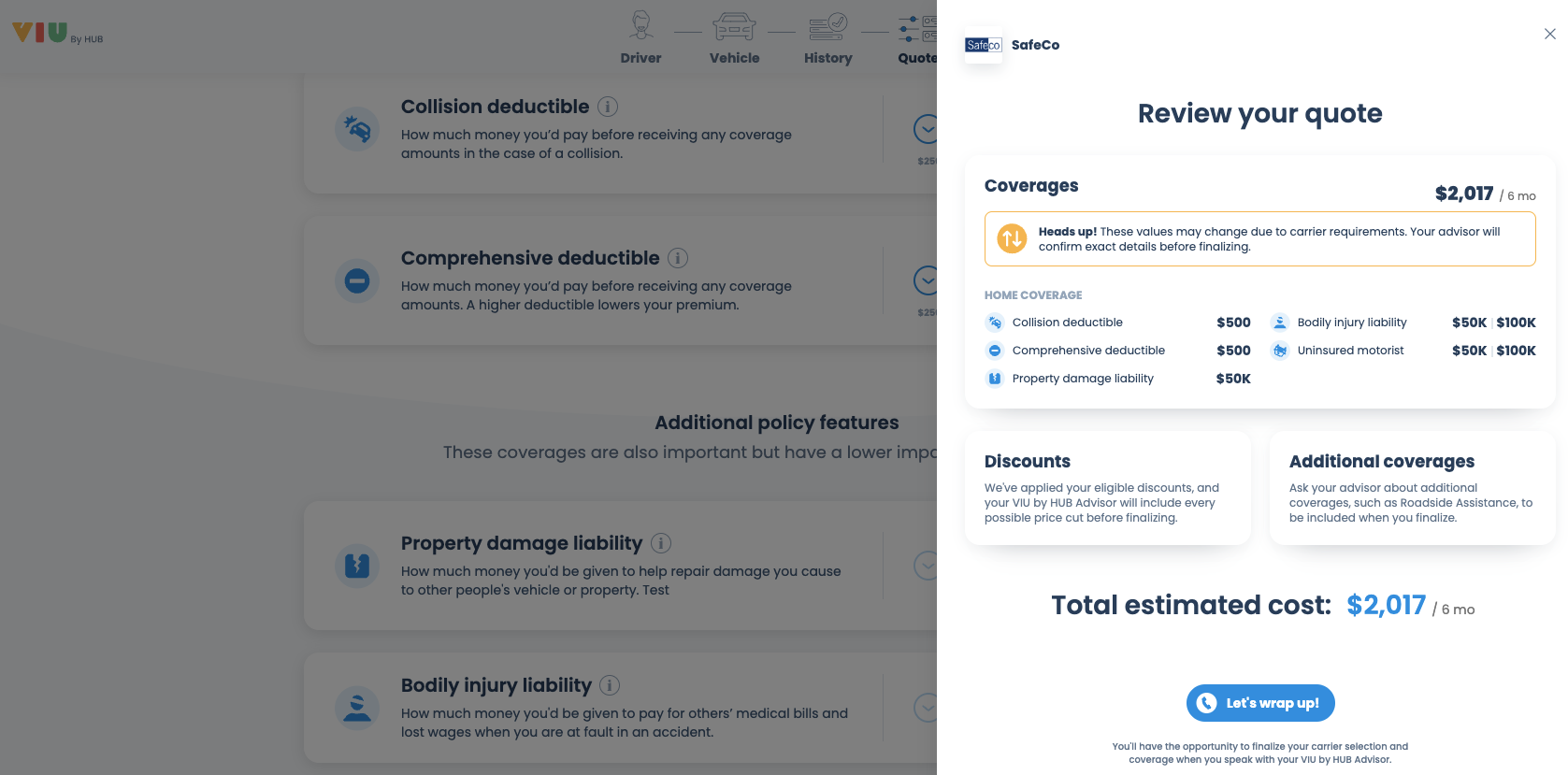

We gave it another try, this time with a New York address, and were able to receive just one auto quote from Safeco.

Aside from receiving quotes, the platform can also aggregate customers’ policies in one place, regardless of carrier or source.

VIU by HUB will deliver insurance solutions through its retail direct-to-consumer channel. Additionally, its new Strategic Partnership program enables companies in different industries to offer insurance through HUB’s branded or white labeled platform.

“As the largest personal lines broker with deep carrier relationships and expertise, HUB has always been focused on the transactional personal insurance customer. Now, HUB is making incredible moves in digital capabilities to dramatically change the consumer experience. VIU by HUB improves the insurance buying experience by offering a comprehensive selection of insurance options powered by unbiased expertise.” – Marc Cohen, president and CEO of HUB.

“We recognize that insurance is complicated and is constantly advancing. Each age and stage of life comes with different needs. VIU by HUB was developed to help make sure our customers are properly insured – that no one is devastated by an insurable event. It improves the insurance buying experience for customers by offering choice, convenience, neutrality and credibility; by leveraging modern digital capabilities built upon the strength of a large, knowledgeable and experienced insurance broker.” – Bryan Davis, EVP, head of Personal Lines Strategy & Business Development at HUB.

Bottom Line: Deja VIU?