Introducing Caribou’s new insurance flow

Caribou , the troubled auto refinancing platform, has a new insurance flow.

For context, Caribou was established in 2016 and has since raised over $190 million, reaching a peak valuation of $1.1 billion.

The startup said that it had pilot relationships with Progressive, Chime, and other companies in February 2020. Later, it launched an auto insurance platform with an integration to Clearcover (to name one) so that potential customers could get a quote online.

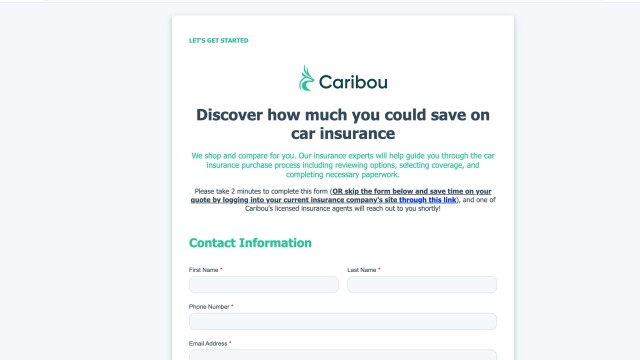

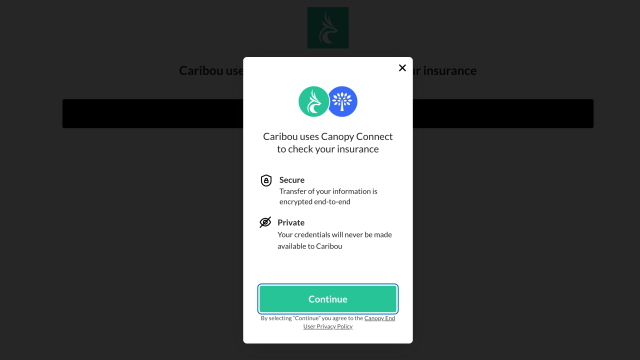

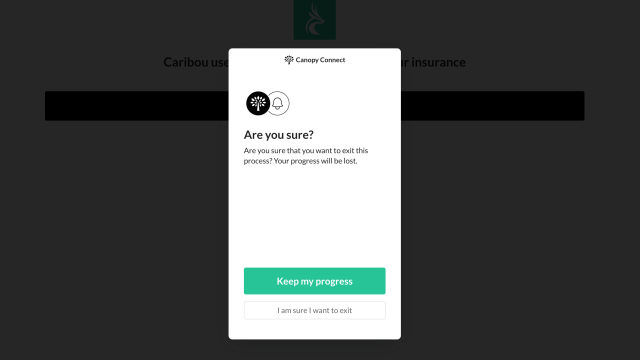

Now, there are two ways to request a car insurance quote. Users can access a portal provided by Canopy Connect to request a quote if they currently have insurance, or they can fill out an online form to request a call from a Caribou agent.

Canopy Connect , a company founded in 2020, competes with Trellis in the area of automating the collection of personal data for the purpose of developing embedded insurance programs. According to LinkedIn data, the San Francisco-based company has a staff of 16 people, under the direction of Tolga Tezel.

Bottom Line: In our recent research report titled The State of Insurance APIs, we shared that Caribou deals with cost-conscious consumers and that it provides an insurance comparison service on its website, but the outcomes can be unpredictable. In the context of our 3 Rs of an embedded insurance strategy, Canopy Connect may have won a client but not a good business.