Just Auto Insurance expands pay-per-mile insurance

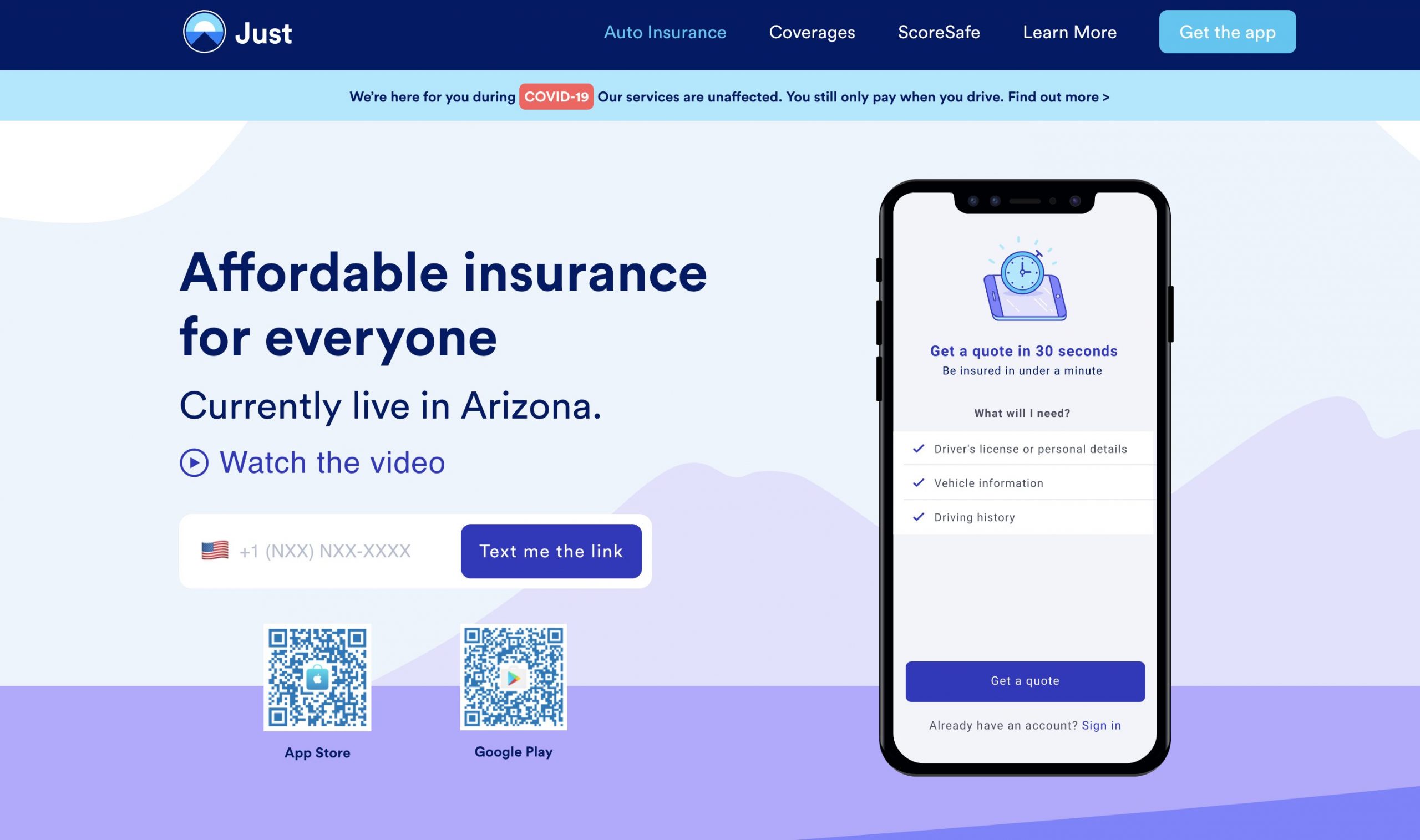

Los Angeles-based pay-per-mile insurance provider Just Auto Insurance has expanded its app-based auto insurance to include collision, comprehensive, full-glass and liability coverage for eligible drivers in Arizona.

Founded in 2019, the startup which also goes by SF Insuretech Inc., is a team of 31. It is targeting lower-income consumers with a 30-day pre-paid, pay-per-mile liability insurance and drivers only need to add $30 to get started.

“If you drive safely, your premium prices will fall. It’s that simple. Our vision is to make auto insurance accessible to everyone, regardless of age, income, marital status or credit scores. It’s a revolutionary concept, really. We’re not looking at demographics to set premiums, because that can adversely affect students, young professionals and the economically disadvantaged. It’s about how you drive, not who you are. We’re incentivizing our policy-holders with lower premiums for safe driving. It’s a meritocracy rather than a bureaucracy. It’s fairer. It’s cheaper. And it’ll make the roads safer.” – Robert Smithson, Just Insure founder and CEO.

Just Insure’s model is entirely app-based—no vehicle tracking device needed. Premiums are determined by a personalized driver rating or “SafeScore”. A driver’s SafeScore is calculated based on speed, cornering, braking and accelerating, junctions, distractions and road conditions. The mobile app sends location and motion data directly to Just Insure after each trip. Just Insure provides in-app feedback and coaching for improvement and the price-per-mile premium resets every month to reflect a driver’s SafeScore.

Last month, the company filed its Form D with the SEC in connection to a debt round totaling $3 million.