Lili believes the future of work is freelance

New York-based banking app for freelancers Lili raised a $15 million funding round led by Group 11, with participation from Foundation Capital, AltaIR Capital, Primary Venture Partners, Torch Capital, and Zeev Ventures. The funding brings the total amount raised to $25 million, following the company’s seed round in June.

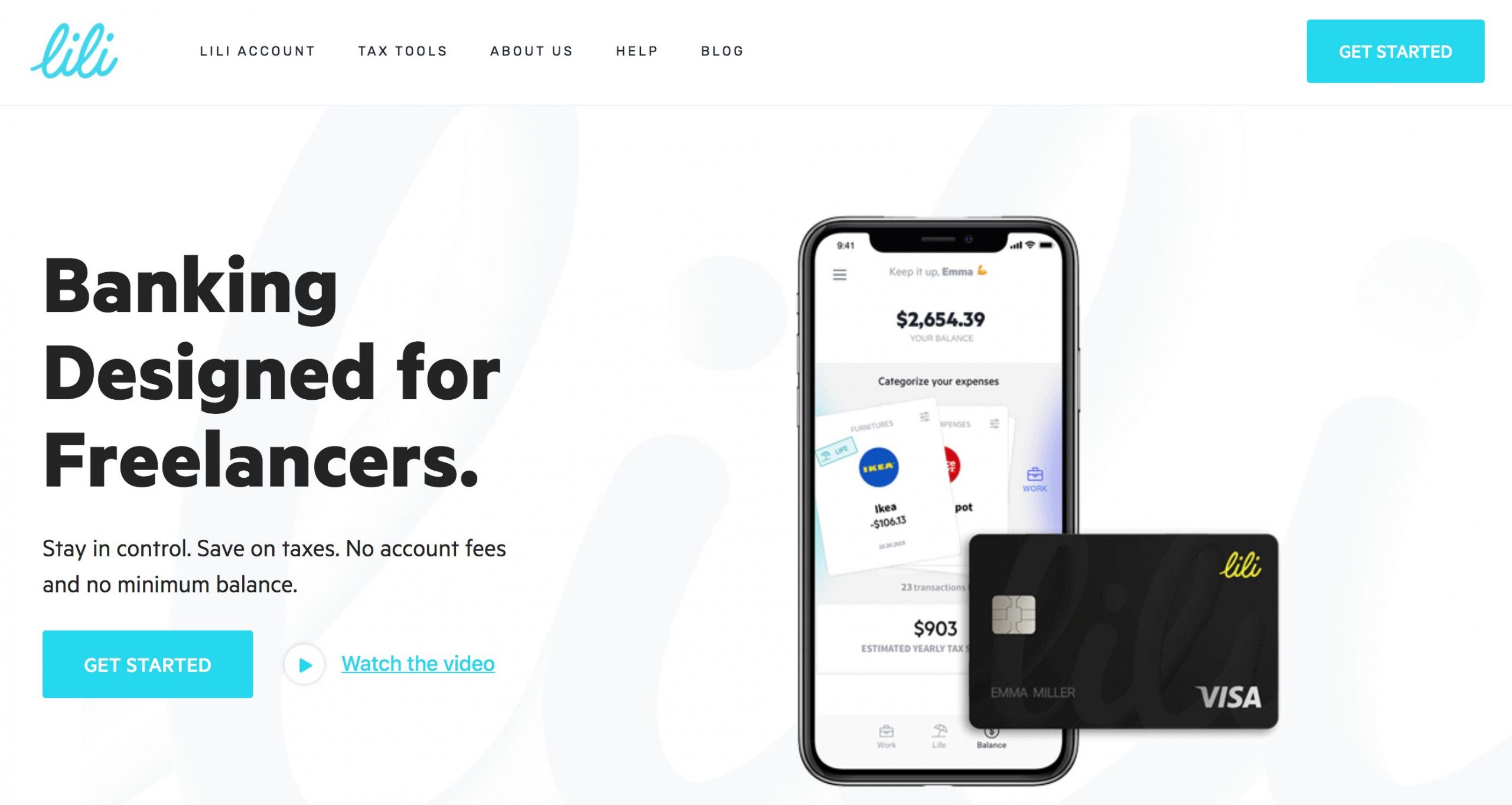

Founded in 2018, Lili combines banking services with real-time expense tracking, tax tools, and financial insights by offering benefits such as free access to 38,000 ATMs without a minimum balance requirement and zero account, overdraft, or foreign transaction fees. Its customers span across many industries, from e-commerce shop owners to designers, programmers, fitness instructors, construction workers, chefs, beauty professionals, and more.

Its banking app features include expense management and reports, digital debit cards, and the ability to instantly send and receive money through Google Pay, in addition to Cash App and Venmo.

“We believe the future of work is freelance , and as the pandemic has recently changed everything about how people approach their careers, the American workforce’s shift toward independence has accelerated even faster than we anticipated. Our mission is to empower freelancers to better manage their money and businesses, and we’ve seen exponential growth in demand over the past several months, as more people are looking for all-in-one financial solutions that are tailored to the unique ways they work. We are looking forward to expanding our product suite and market leadership while providing freelancers with an unparalleled banking experience.” – Lili co-founder and CEO Lilac Bar David.

Bottom Line: There are nearly 60 million freelancers in the US. In addition, as a result of COVID-19, 12% of the US workforce started freelancing this year. This accelerated shift toward independent work has led to nearly 100,000 freelancers opening Lili accounts since its launch. The average monthly spending per customer has more than doubled in 2020.