Marble raises $2.5 million

Marble, “the first digital wallet and loyalty platform for insurance,” has raised $2.5 million in seed funding. Marble’s investors include IA Capital Group, MS&AD Ventures, Reciprocal Ventures, Fintech Ventures Fund, The Takoma Group, and HU Investments.

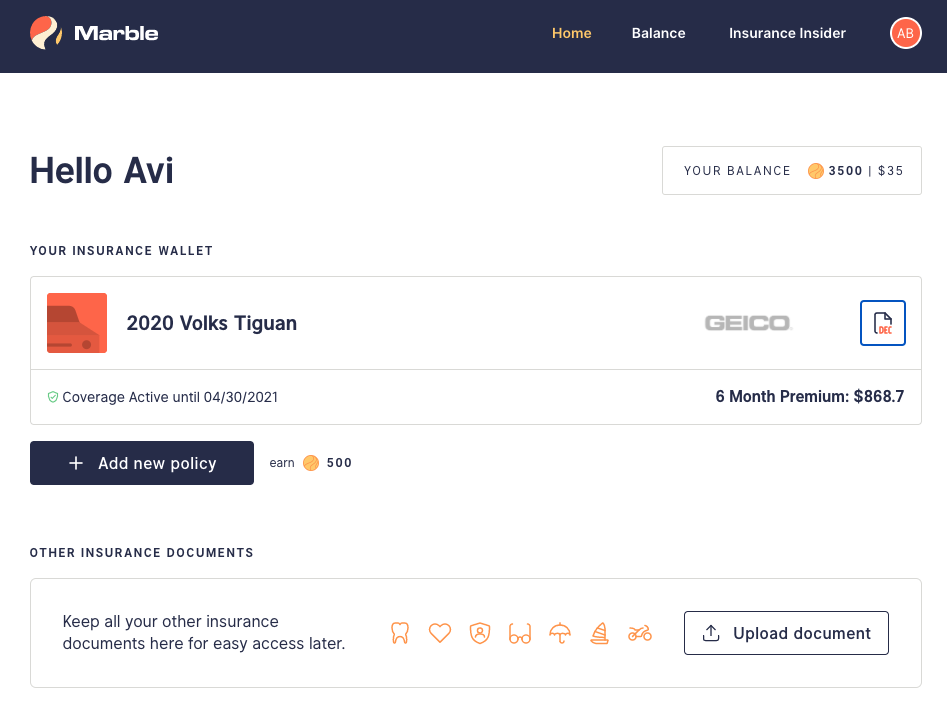

We’ve previously shared our thoughts on Marble, a company that encourages users to upload their insurance policies so that it can later provide them with relevant insurance offers and potential savings. Once you upload the policy docs, the information is displayed in your ‘insurance wallet’ section.

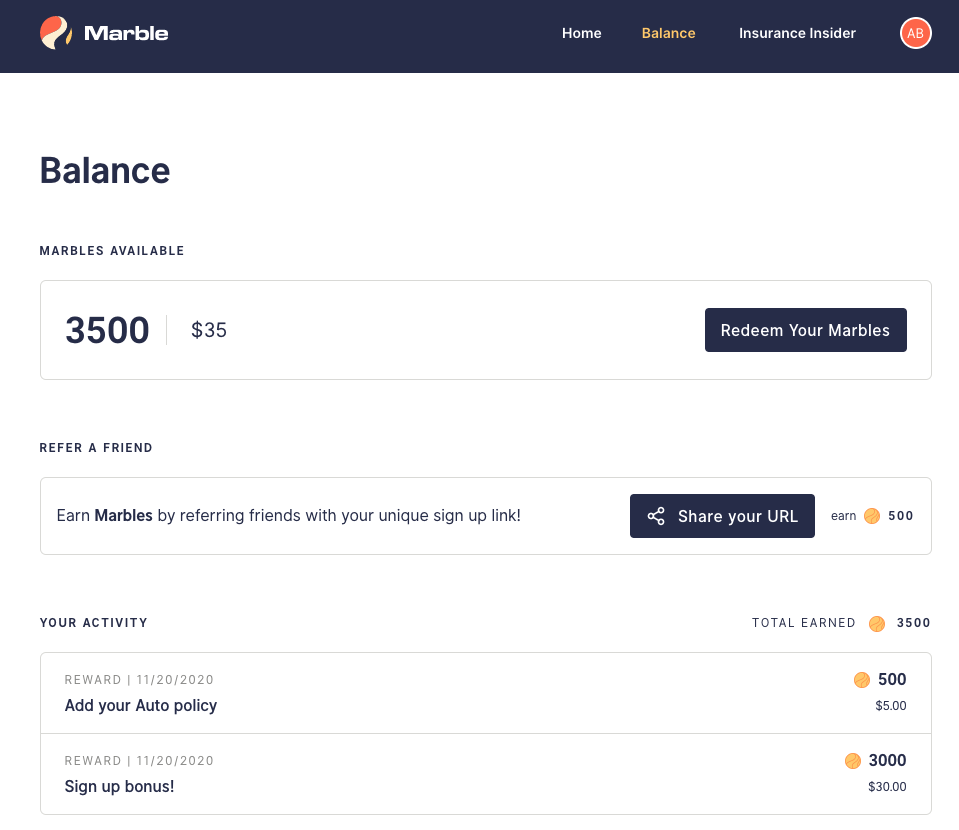

To incentivize users, Marble, which is currently in beta, offers cash rewards that can currently be redeemed via Visa or Amazon gift cards. The startup says that users will also be able to redeem rewards by applying them towards their insurance payments.

Marble is working on an additional feature that is set to launch in the next few weeks – automated insurance rate shopping – and since my policy is up for renewal, I’ll keep you posted.

“Marble is the first truly transformative insurtech product in a long time. We provide a simple, personalized wallet for our members to take control of all of their insurance — and earn rewards while doing it. The vast majority of insurtech investment over the last decade has been in technology that sells more insurance, faster. Meanwhile, insurance companies continue to spend billions on advertising to attract customers that they will only engage with once a year. Marble’s insurance partners leverage our API-powered tech to offer precise rewards tailored to their customers – who stay engaged through rewards and notifications, as well as the ability to bundle, compare, and keep track of all of their policies at a glance. All of this dramatically increases the likelihood of engagement and renewal. Marble is the most engaging and literally rewarding way for the 92% of Americans who are insurance customers to deal with their insurance and insurance companies. We’ll also soon have incredible tools that will allow agents and brokers to engage, retain, and acquire business. This investment sets Marble up to grow our team, commit to new partner integrations, and finally start realizing insurtech’s promise as a movement that can actually make people feel good about their insurance.” – Stuart Winchester, founder & CEO at Marble.

“Marble is a win-win for customers and insurers. Customers are demanding a better way to manage their disparate policies and accounts. Insurers want a better way to engage with customers. Both would rather have insurers spend billions of dollars less on advertising, and have Marble give those billions of dollars back to the customer. As the longest tenured and most experienced venture capital firm predominantly focused on insurtech, IA Capital couldn’t be more pleased to have incubated and invested in Marble, an ambitious insurtech company that has the potential to uniquely disrupt all personal lines of insurance.” – Andrew Lerner, the Managing Partner of IA Capital Group.

“We really love what the team is building at Marble. Marble is giving power and transparency back to consumers, along with rewards. It’s creating a brand new experience for the next generation of insurance policy holders. MS&AD Ventures is excited to be part of the journey as Marble scales and grows its world-class fintech team.” – Tiffine Wang, Partner at MS&AD Ventures.