Mile Auto raises $10.3 million

Atlanta-based MGA offering pay-per-mile insurance Mile Auto announced that it has secured $10.3 million in seed funding. Investors include Ulu Ventures, Emergent Ventures, Thornton Capital, and Sure Ventures.

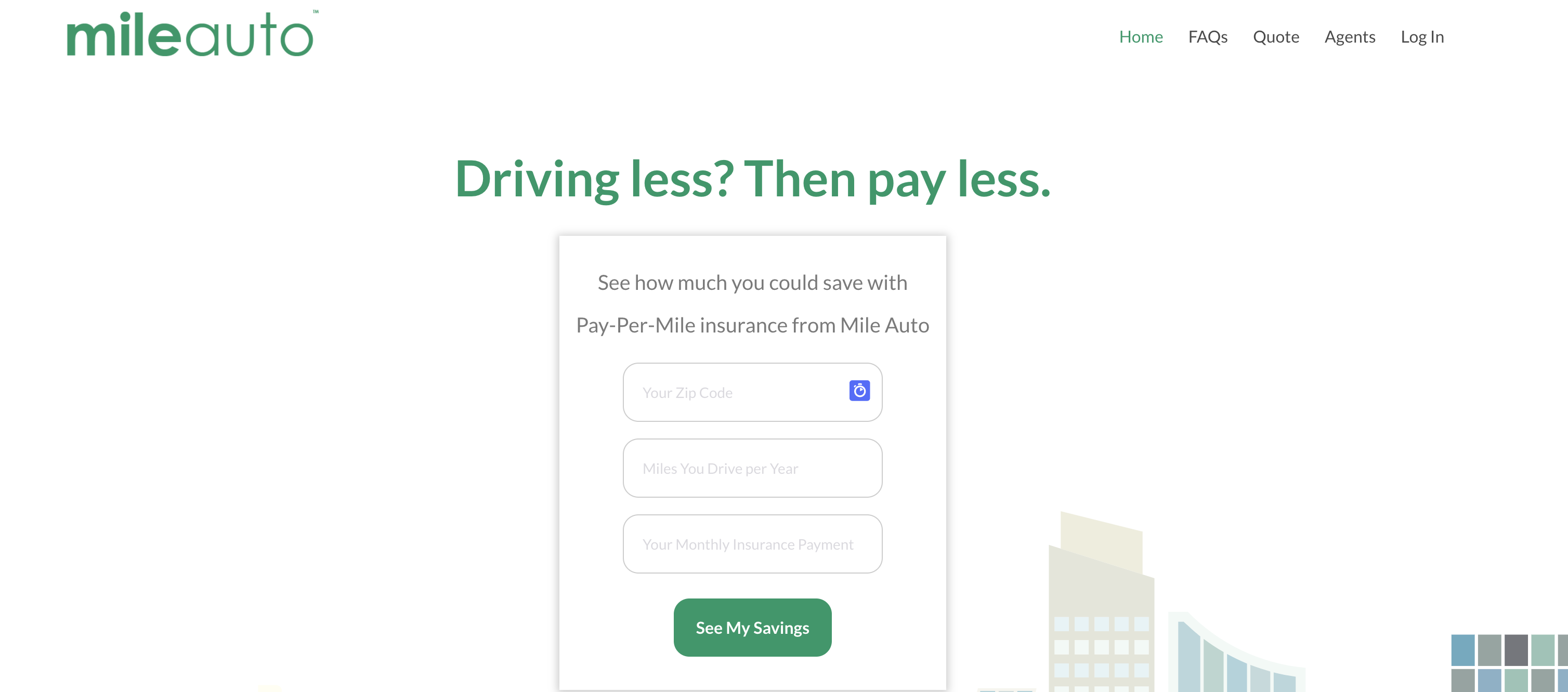

Founded in 2016, Mile Auto leverages its technologies to collect and validate odometer data without the need for extra hardware, mobile apps or GPS tracking. Drivers pay only for what they use, resulting in savings of up to 60% according to the company. Currently Mile Auto is available in Arizona, Georgia, Illinois and Oregon, with plans to expand into additional states within the next six months.

“The auto insurance industry has operated decades behind other industries that have undergone digital transformation. Today it is at a pivotal juncture where innovation is finally unlocking cost savings for consumers. Mile Auto’s data-driven approach to insuring an underserved segment, lower-mileage drivers, is exactly what the market needs right now. We place a high value on transparency, values and vision, and we believe that Mile Auto’s founding team of serial entrepreneurs can have a great impact on the industry. This is demonstrated by innovative partnerships they’ve struck, like the one they are announcing today with Ford. This is why we invested early, and we’re excited to be a part of the company’s journey as they grow.” – Miriam Rivera, CEO, co-founder and managing director of Ulu Ventures.

The company also announced a partnership with Ford Motor Company to save Ford owners on their auto insurance rates. In 2019, Mile Auto launched a similar program with Porsche Financial Services. Through Mile Auto’s technology-driven and privacy-centric pay-per-mile approach, Ford owners who drive under 10,000 miles per year could potentially save between 30% and 40% off their current rates. By leveraging onboard telematics data from current Ford models, Ford owners can choose to share mileage data with Mile Auto. Mile Auto does not require smartphones, mobile apps or other hardware to take advantage of lower rates.

“At Ford, we are focused on ways to improve our drivers’ experiences through connectivity. Today, some of us are spending less time in our cars and keeping an even closer eye on ownership costs as a result. Our relationship with Mile Auto provides connected Ford customers with a better way to align their auto insurance expenses with actual usage and is part of Ford’s commitment to customer experience innovation through connectivity.” – Tim Meek, North America digital insurance manager for Ford Enterprise Connectivity.

“Mile Auto makes car insurance fair and transparent for lower mileage drivers who have been overpaying and underserved for too long. With this funding, we will aggressively expand our footprint into new states, grow our team to best serve our customers, expand our network of automotive and enterprise partners, and accelerate the momentum we’ve gained so far.” – Fred Blumer, CEO of Mile Auto.

Mile Auto will use the funding to expand availability of its insurance offering to half of the US auto insurance market by the end of 2021, as well as hiring, adding new distribution channels, onboarding of white-label partners, and expanding its automaker network.