NJM Insurance expands business insurance into Pennsylvania

NJM Insurance Group is now writing BOP, corresponding excess and umbrella policies, and commercial auto policies in Pennsylvania.

“NJM has earned a reputation as a company committed to fulfilling the insurance needs of its policyholders with the highest levels of service. We are thrilled to bring our 108-year business insurance legacy to the Pennsylvania marketplace.” – Mitch Livingston, NJM president and CEO.

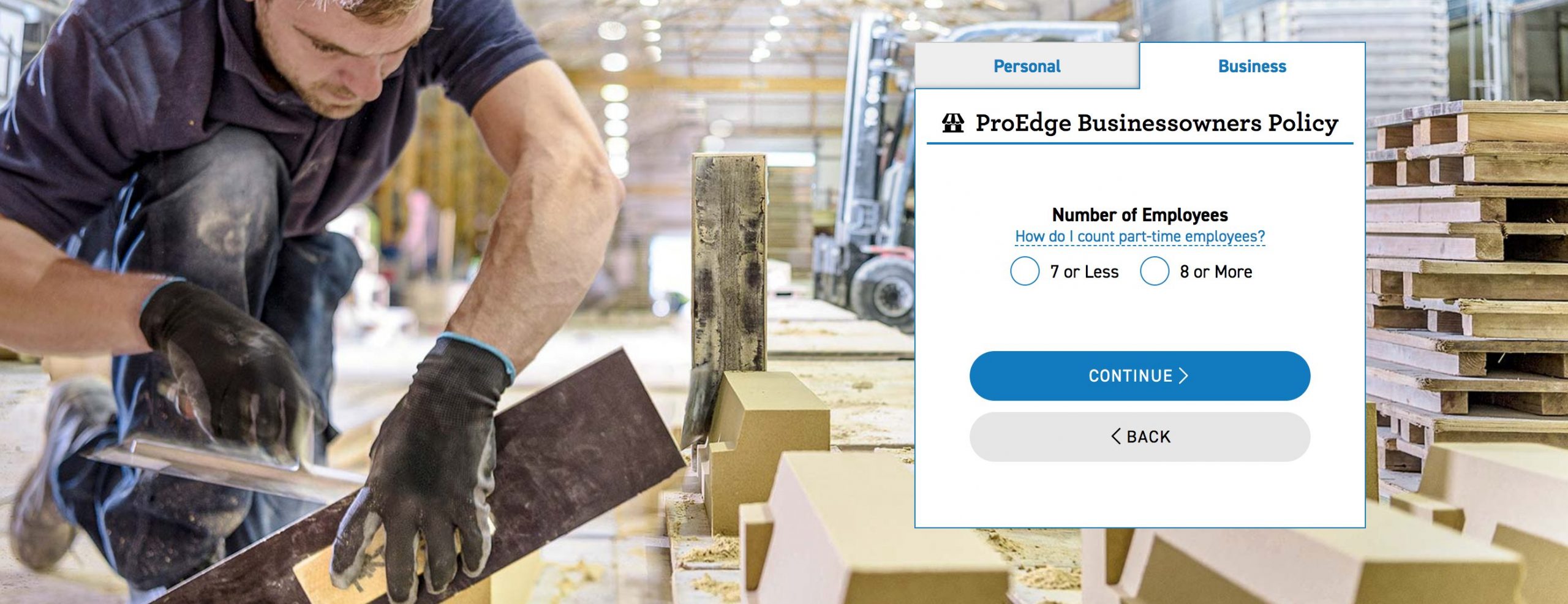

The ProEdge Businessowners Policy provides protection for property and liability risks associated with small businesses. NJM’s Commercial Excess and Umbrella policy can expand coverage and provide higher limits of liability for ProEdge policyholders. Businesses can apply for these products by connecting with a Premier agent, however, entities with 7 or fewer employees may also apply for coverage directly at njm.com.

“NJM successfully launched its workers’ compensation insurance in Pennsylvania in 2018. We are excited to roll out our full line of business insurance products to help further support businesses throughout the Keystone State.” – Arjay Pedalino, NJM vice president of commercial lines.

The product expansion comes at a time when NJM is implementing its multi-year strategic plan, widening its geographic footprint as a regional carrier. The Company is among the leading writers of workers’ compensation insurance in the Mid-Atlantic region. It offers business insurance in Connecticut, Delaware, Maryland, New Jersey, New York, and Pennsylvania.

Bottom Line: We have reason to believe Surfly is in the mix.