Novo raises $90 million

Small business banking platform Novo has raised $90 million in Series B funding at a $700 million valuation. Stripes led the round, with continued participation from existing investors Valar Ventures, Crosslink Capital, Rainfall Ventures, and BoxGroup.

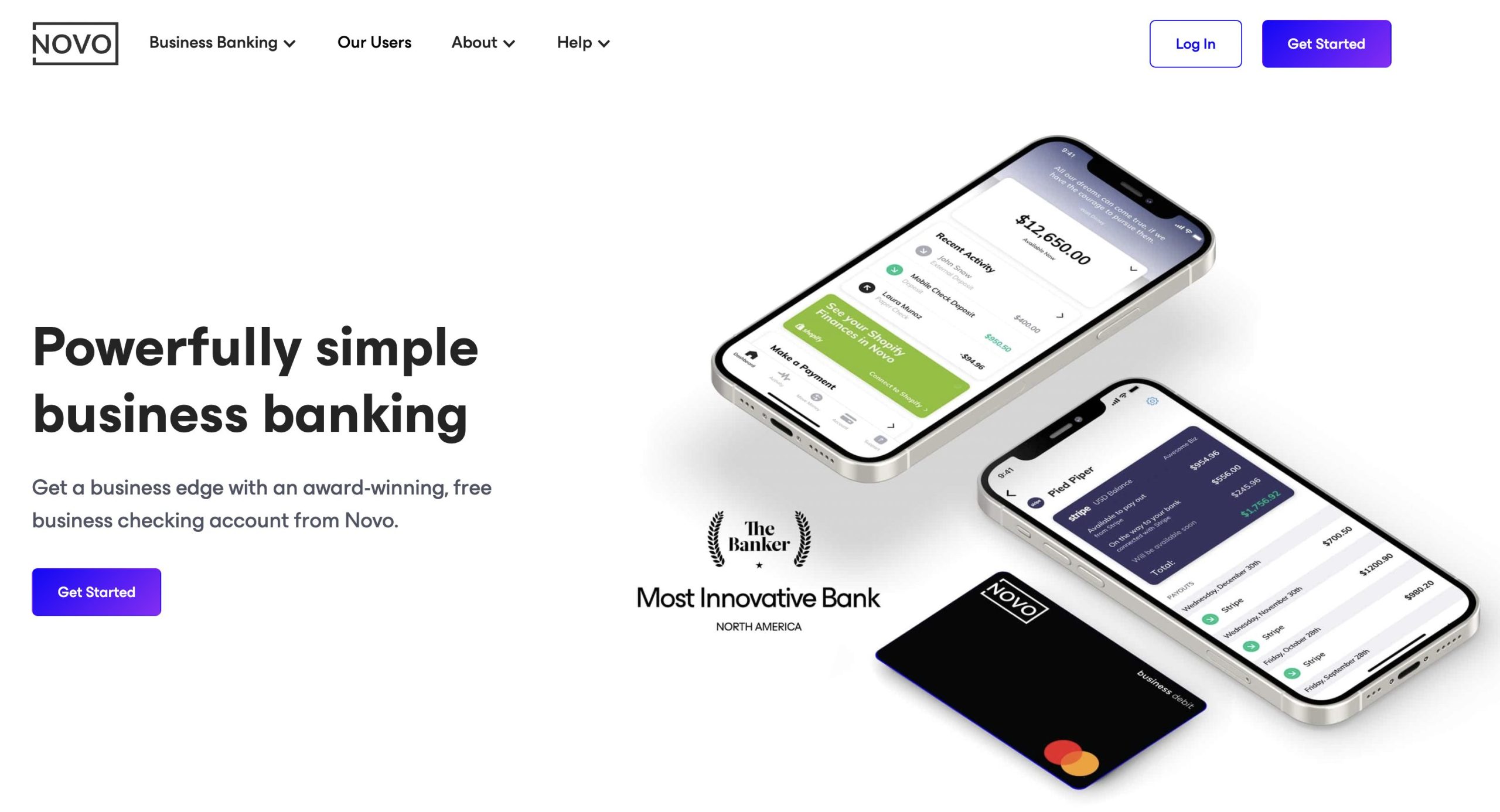

Launched in 2018, Novo is based out of New York and Miami and offers business users a variety of tools including invoicing, cash flow insights, and a free business checking account. The startup has surpassed $5 billion in lifetime transactions with $4 billion taking place in 2021.

“After speaking with thousands of our more than 150,000 customers over the last few years, one theme keeps coming up: the more you can help a small business remove all red tape and friction around cash flow, the better off that business is. With this additional funding, Novo will take a huge leap forward in improving cash flow for small businesses. In the coming months and years, our small business customers will be able to access their funds faster than they ever thought possible.” – Michel Rangel, CEO and co-founder of Novo.

“Despite being the heart of the U.S. economy, the more than 30 million small businesses in the U.S. have always struggled to access even basic financial services as they are constantly overlooked by the big banks. What sets Novo apart is a fundamentally different approach to helping small businesses succeed. Instead of opting for incremental change, Novo built its banking platform from the ground up so that it could not just deliver a great digital banking experience, but actually deliver de novo financial products to a customer base that is yearning for them. At Stripes, we only invest in companies building amazing products, and Novo’s rave reviews, strong retention, and incredible growth make it clear it has built something that small businesses love.” – Saagar Kulkarni, partner at Stripes.

“For small business owners, the technology that powers their digital banking platform should fade into the background. As we look towards the rest of 2022 and beyond, one area we’re particularly excited about is providing short-term capital for reducing cash flow friction, and implementing technologies that can automate this process.” – Tyler McIntylre, CTO and co-founder of Novo.