RiskDV Looks to Provide Insurers with Actionable Insights

Meet RiskDV:

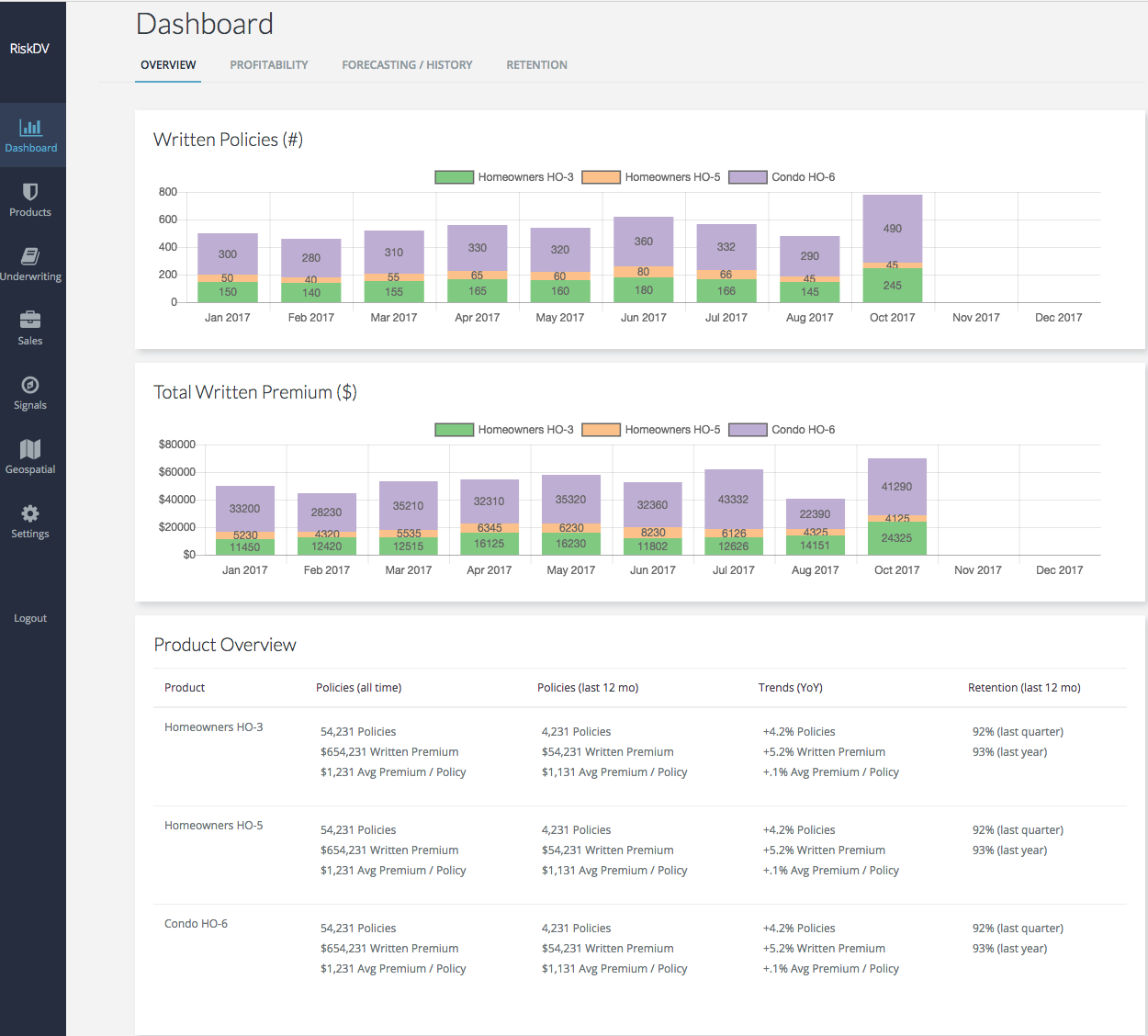

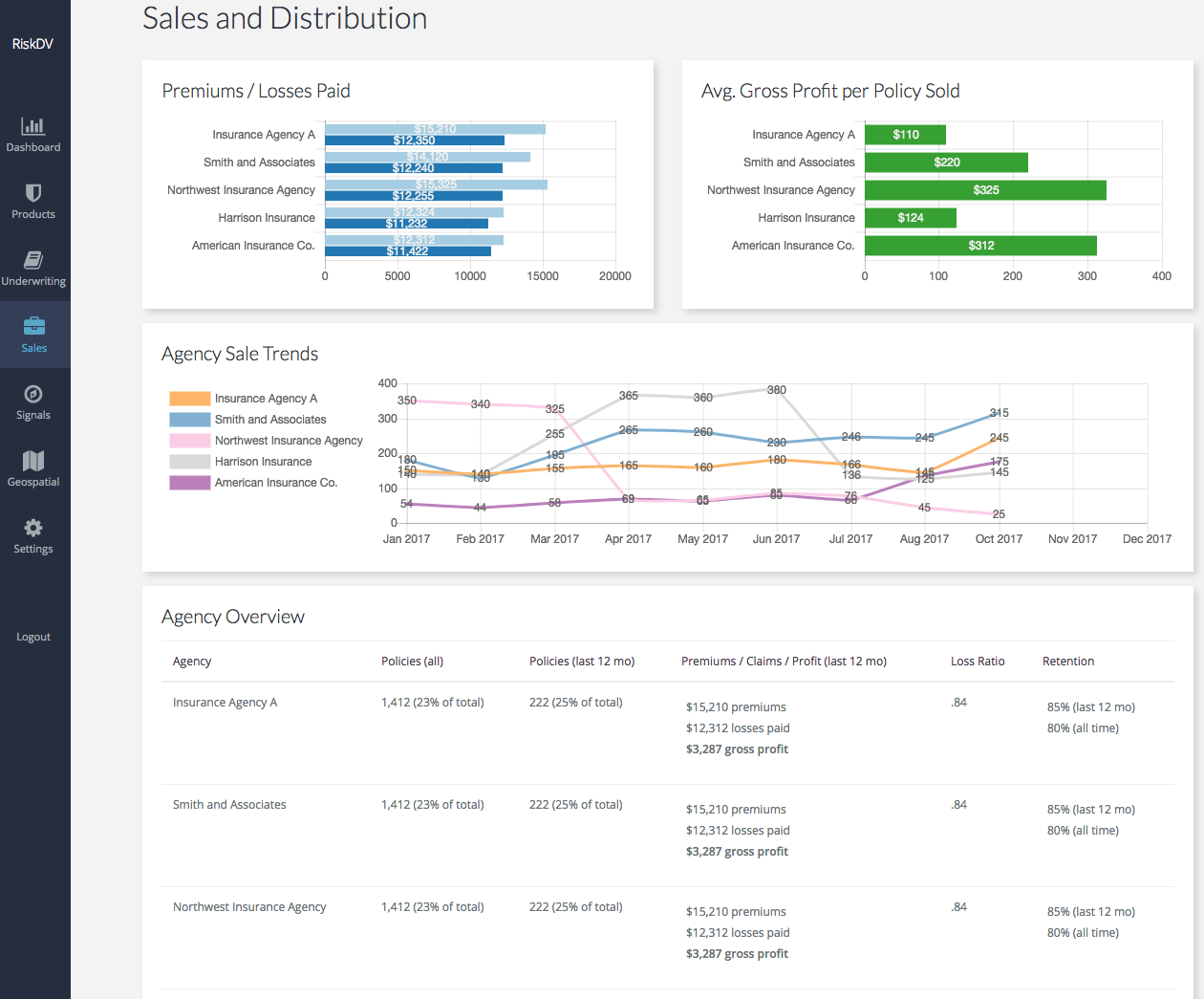

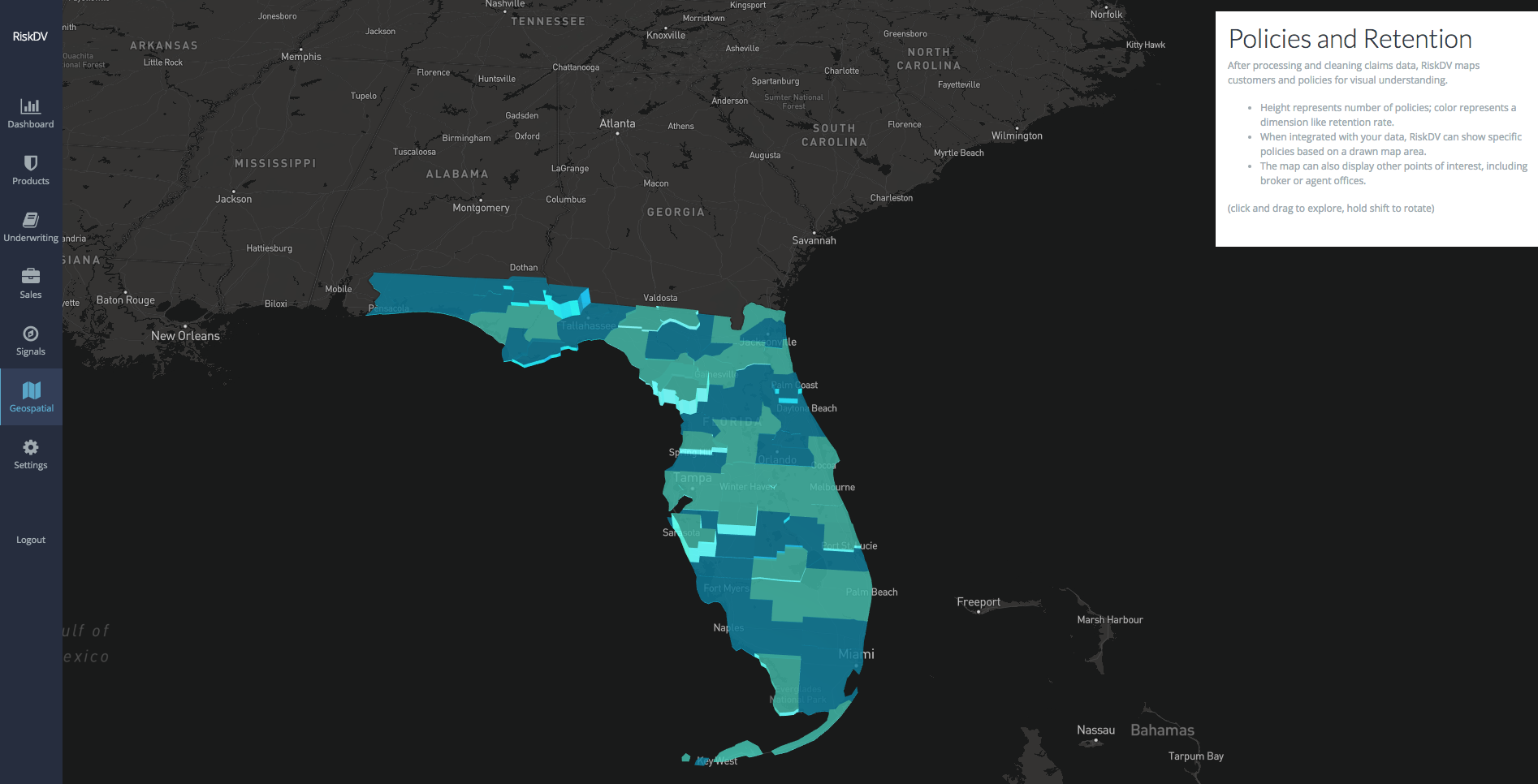

The San Fran-based company was established by Nikhil Chari, Nick Priestley and Kevin Sun earlier this year to improve insurers’ underwriting, sales, and product strategy with data analysis and visualization. By ‘data analysis’, think: policy data, loss ratio, retention ratio, etc. By ‘visualization’, think: dashboards. Here’s how it works: first, RiskDV establishes a process to create integrations to fetch data from the insurer’s systems, then they standardize the data and upload it into a high-performance database for real-time querying, and later, the teams work together to find relevant risk drivers in the data that can provide predictive insights. Look:

From a bird’s-eye view, the startup’s proposition sounds a bit like that of Vertafore’s RiskMatch, though the latter made a point to mostly target insurance agents.