Selective Q4’22 earnings call

Selective hosted its Q4 2022 earnings call on Feb 3, 2023. The highlights:

- 2022 marks Selective’s ninth consecutive year of double-digit non-GAAP operating returns on equity

- Net premiums written were up 14% in the quarter and 12% for the full year

- Growth for the year was driven by overall renewable pure price increases that averaged 5.1%, solid renewable retentions, exposure growth and strong new business.

- 95.1% combined ratio for ’22 included 4.3 points of net catastrophe losses, partially offset by 2.5 points of net favorable prior year catastrophe reserve development

- Selective’s “unique field underwriting model” remains “highly valued” by agency partners.

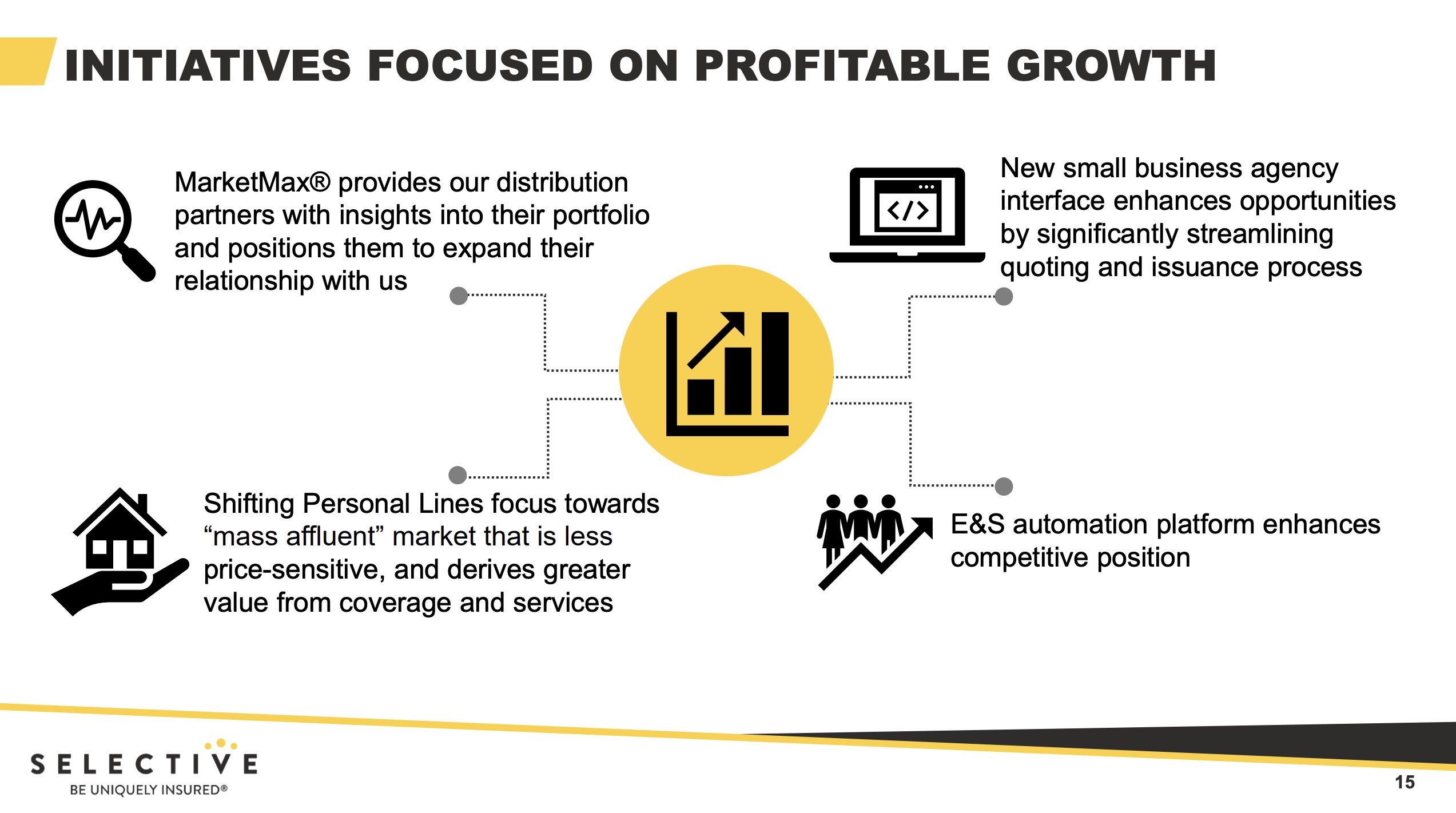

- Its MarketMax tool, which provides distribution partners with insights on their overall portfolio, and identifies target accounts to grow their business with Selective has been “instrumental in generating high quality new business opportunities”

- Expanded commercial lines footprint into 3 additional states in 2022 – Vermont, Idaho and Alabama

- Remains on track to open Maine and West Virginia in early 2024

- Completed the implementation of its new automation platforms for both standard commercial line small business and E&S – both enhance ease of use for their distribution partners

- Appointed 180 new agencies during the year, bringing the total to around 1,500 agencies represented by 2,600 storefronts

- Targeting a 95% combined ratio

- 2023 combined ratio guidance is 96.5% or 92%, excluding catastrophe losses

- In personal lines, its ongoing transition from the mass market to the mass affluent market caused Selective to fall behind the market in pricing trends

- “There’s also been a significant efficiency gain on the part of our field underwriters, because of the virtual tools, they and our agents have become a lot more comfortable using over the last couple of years” – CEO John Marchioni

Get Coverager to your inbox

A really good email covering top news.Related Posts