Wejo expands work with Ford

Connected car data company Wejo , which has accumulated pre-tax losses of around $127 million, announced the US expansion of its insurance offering with Ford Motor Company .

With this partnership, which was first announced in Europe in June, insurance providers will be able to use (with customer consent) connected vehicle data to establish usage-based vehicle insurance policies. This data can help the vehicle insurance industry better validate customer supplied details, identify and minimize insurance fraud, offer more accurate dynamic pricing models, and reduce risks for safer journeys and less stress on policymakers and customers.

“Expanding our joint capabilities with Ford in the U.S. enables mutual benefit to both policyholders and insurers as auto insurance companies leverage connected vehicle data for good. We’re excited to embrace the estimated $1.7 billion by 2030 total addressable user-based insurance market in the U.S. by working with vehicle OEMs to help insurance providers leverage actionable data insights. Our expanded partnership with Ford for end-to-end insurance is a significant step toward reinventing auto insurance for a smarter, safer future.” – Richard Barlow, founder and CEO of Wejo.

Bottom Line I: There are rumors that Wejo and its main rival Otonomo , both of which have substantially lost value since becoming public, are thinking about merging. This emphasizes how crucial it is to have access to data that can be monetized.

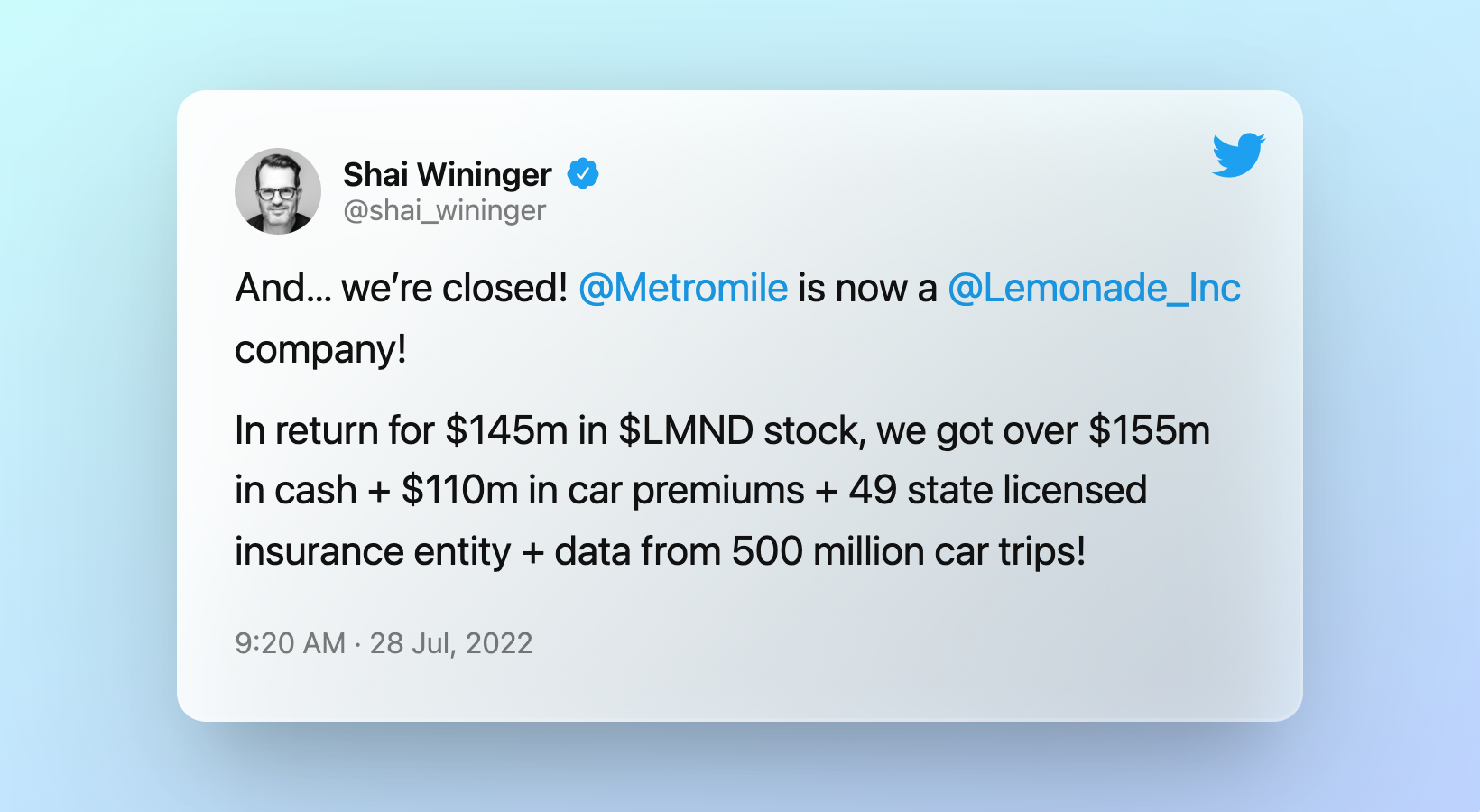

Bottom Line II: “End-to-end insurance” is a fancier term for usage-based insurance. The poster child for this model is Metromile that was acquired for less than what it had in the bank. The end.