Caribou raises $115 million at a $1.1 billion valuation

Auto refinancing company Caribou closed a $115 million Series C funding round, at a $1.1 billion valuation, bringing its total funding to $190 million. The round was led by Goldman Sachs, with participation from new investors Innovius Capital, and Harmonic, and existing investors Accomplice, TruStage Ventures , Curql Fund, Firebolt Ventures, Gaingels, Moderne Ventures, Motley Fool Ventures, and others.

Founded in 2016, Caribou allows customers to refinance their car loans, claiming its saves customers an average of over $100 a month on their new auto loans.

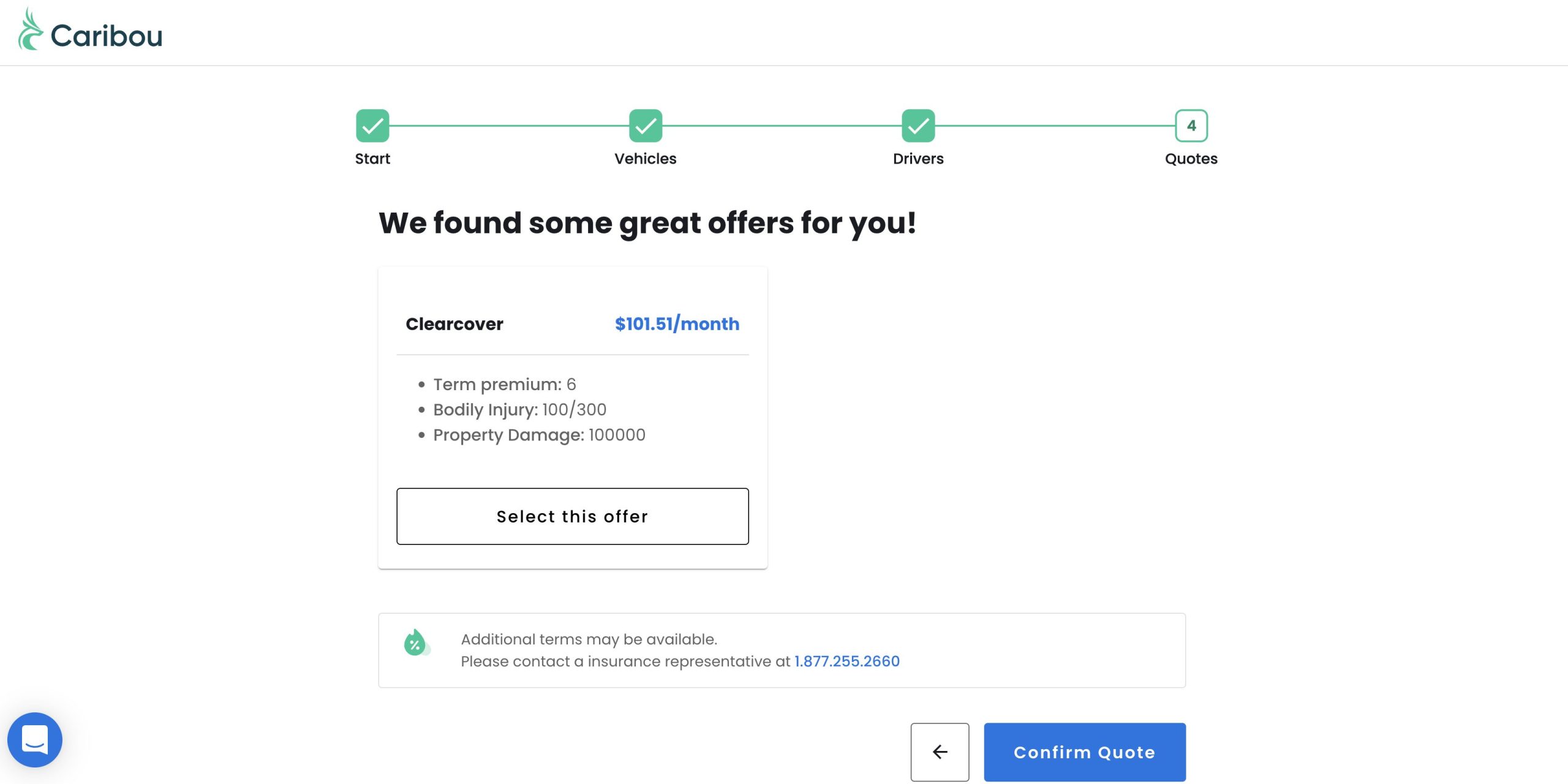

When it comes to insurance, it offers a car insurance comparison service, however, my experience resulted in a single quote from Clearcover and the coverage isn’t offered via a fully-digital process.

Caribou states that it has refinanced over $1.5 billion in loans and that it has scaled its business operations across Washington D.C. and Denver, as well as remotely, building a 500-person workforce, up from roughly 40 employees two years ago.

“We are putting people in control of their auto finances, saving them thousands of dollars with a fast and easy process. We’re proud of what we are building and grateful to have such a talented team and experienced group of investors backing our vision. We are just getting started.” – Caribou CEO Kevin Bennett.

Bottom Line: Caribou is your non-traditional insurance intermediary; in the making as of 2020.